IRS Form 1098-T

On this page:

- General Information

- Official 2025 IRS Form 1098-T Instructions for Students

- Additional Information Regarding IRS Form 1098-T

- 1098-T Guide for Students

General Information

Wright State University follows new IRS reporting requirements that became effective for Calendar Year 2018 by system generating IRS Form 1098-T annually for students with qualified tuition and related expenses (QTRE) paid in excess of scholarships and grants. Under IRS guidance prior to 2018, Wright State University reported Qualified Tuition and Related Expenses (QTRE) billed.

Per Internal Revenue Service Instructions for Form 8863, education credits are based on the amount of adjusted qualified education expenses paid in 2025 (e.g. check, cash, credit cards, loans, financial aid) for academic periods beginning in 2025 or the first 3 months of 2026.

Additional information regarding your student account activity can be found by logging onto WINGS and viewing your 2025 electronic billing statements.

- To view student account information, select Student Accounts/Bursar Services tile in the right navigation pane, select Student Account Center, which will take you to our e-commerce site. At the e-commerce site, select either "View Activity" or “View Statements” to review charges and payments on your account.

- Students can view 1098-T statements online by clicking "Official 1098-T Tax Document" under the Student Accounts/Bursar Services link in WINGS. At the site choose "Statements" under My Account, then choose the 1098-T tab. If you do not see a statement here Wright State University is not required to provide an official 1098-T. All students can see the documentation for the 1098-T by clicking on “1098-T Document Information” under the Student Account Center/Bursar Services tab in WINGS. You along with any authorized users you designate can also view your statements through our e-commerce site.

Upon signing the Financial Agreement each semester students are agreeing to receive their 1098-T electronically. This allows the student to have access through their student account at any time and print as needed. The document is available immediately upon publication and no need to wait on mail delivery. Wright State University recommends receiving the 1098-T electronically but understand some students would prefer to have the document mailed. Visit this website to opt out of receiving the 1098-T electronically. Be sure to uncheck the box and hit submit. You can come back and opt back in to receive the 1098-T electronically anytime.

Wright State University cannot offer tax advice; therefore, we encourage students to consult with a tax advisor to determine eligibility for any educational tax benefit. Additional information regarding Education Tax Benefits can be found at IRS.gov by searching for education tax benefits.

Emergency financial aid received as part of the CARES Act, Coronavirus Response and Relief Supplemental Appropriations Act or the American Rescue Plan are qualified disaster relief payments under section 139 of the Internal Revenue Code and is not included in your Payments Received (Box 1) unless you authorized such emergency financial aid to be applied against your account balance (net of any associated refund). Emergency financial aid is not included as Scholarships or Grants (Box 5) regardless if the emergency financial aid was directly distributed to you or applied against your account. Additional information can be found at: https://www.irs.gov/newsroom/higher-education-emergency-grants-frequently-asked-questions

Please reference the 1098-T Guide (PDF) for a detailed description of the 1098-T.

Official 2025 IRS Form 1098-T Instructions for Students

You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040 or 1040-SR. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related expenses to you. This statement is required to support any claim for an education credit. Retain this statement for your records. To see if you qualify for a credit, and for help in calculating the amount of your credit, see Pub. 970, Form 8863, and the Instructions for Form 1040. Also, for more information, go to www.irs.gov/Credits-Deductions/Individuals/Qualified-Ed-Expenses.

Your institution must include its name, address, and information contact telephone number on this statement. It may also include contact information for a service provider. Although the filer or the service provider may be able to answer certain questions about the statement, do not contact the filer or the service provider for explanations of the requirements for (and how to figure) any education credit that you may claim.

Student’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the issuer has reported your complete TIN to the IRS. Caution: If your TIN is not shown in this box, your school was not able to provide it. Contact your school if you have questions.

Account number. May show an account or other unique number the filer assigned to distinguish your account.

Box 1. Shows the total payments received by an eligible educational institution in 2025 from any source for qualified tuition and related expenses less any reimbursements or refunds made during 2025 that relate to those payments received during 2025.

Box 2. Reserved for future use.

Box 3. Reserved for future use.

Box 4. Shows any adjustment made by an eligible educational institution for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax liability for the year of the refund). See “recapture” in the index to Pub. 970 to report a reduction in your education credit or tuition and fees deduction.

Box 5. Shows the total of all scholarships or grants administered and processed by the eligible educational institution. The amount of scholarships or grants for the calendar year (including those not reported by the institution) may reduce the amount of the education credit you claim for the year. TIP: You may be able to increase the combined value of an education credit and certain educational assistance (including Pell Grants) if the student includes some or all of the educational assistance in income in the year it is received. For details, see Pub. 970.

Box 6. Shows adjustments to scholarships or grants for a prior year. This amount may affect the amount of any allowable tuition and fees deduction or education credit that you claimed for the prior year. You may have to file an amended income tax return (Form 1040-X) for the prior year.

Box 7. Shows whether the amount in box 1 includes amounts for an academic period beginning January–March 2026. See Pub. 970 for how to report these amounts.

Box 8. Shows whether you are considered to be carrying at least one-half the normal full-time workload for your course of study at the reporting institution.

Box 9. Shows whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential.

Box 10. Shows the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer. The amount of reimbursements or refunds for the calendar year may reduce the amount of any education credit you can claim for the year (may result in an increase in tax liability for the year of the refund).

Future developments. For the latest information about developments related to Form 1098-T and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form1098T.

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online federal tax preparation, e-filing, and direct deposit or payment options.

Additional Information Regarding IRS Form 1098-T

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. You can find detailed information about claiming education tax credits in IRS Publication 970.

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

Note: A Form 1098-T will be system generated only for those individuals who paid qualified tuition and related expenses in excess of scholarships during the calendar year.

Wright State University is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser.

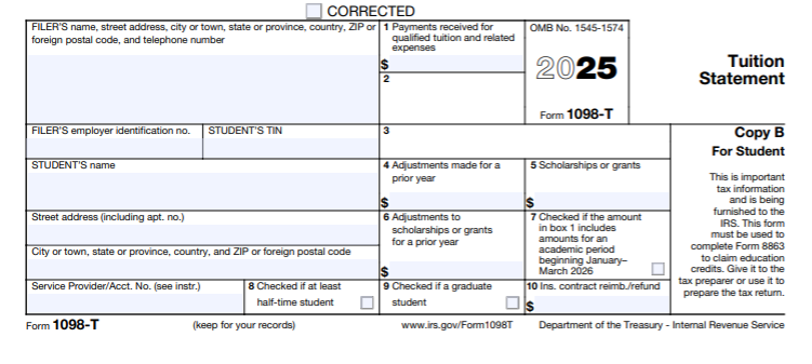

Below is a blank sample of the 2025 Form 1098-T, that you may receive in January 2026, for your general reference. For more information about Form 1098-T, visit https://www.irs.gov/pub/irs-pdf/f1098t.pdf.

1098-T Guide for Students

Only students with Qualified Tuition Related payments (Box 1) greater than Scholarships or Grants (Box 5) or a prior year adjustment (Box 4 or Box 6) will be issued a 1098-T (and reported to the IRS). If you did not provide electronic consent, a 1098-T form will be mailed to you, otherwise it will be available for printing via WINGS in our e-commerce portal where you view your electronic billing statements. Even if you were excluded from being issued a 1098-T form, you can still obtain a representation of your 1098-T form from WINGS.

Generally, Box 1 will be the lesser of payments received or Qualified Tuition Related Expenses (QTRE). In most cases it with be the QTRE. Box 1-Payments Reportable on the WINGS web statement details the calculation of your Box 1 (See Key Information Displayed in WINGS section).

QTRE includes the following1:

- Tuition and most fees

- Inclusive courseware (electronic textbook materials)

- Career services fee

- Campus Engagement Fee

QTRE does not include some of the following1:

- Room and meal related fees

- Health insurance

- Student legal fees

- Counselling/Wellness services fee

- Parking permits and fines

- Installment payments fees or late fees

A summary of qualified charges and payments and non-qualified charges and payments can be found by accessing your 1098-T statement from WINGS. It cannot be found on the form provided on our E-commerce portal via TouchNet. The form in our e-commerce portal can be used for your IRS filing.

Generally, payment or charge related adjustments related to 2025 activity will be reported in Box 4 if the net adjustments are negative. Adjustments related to 2025 activity that net to a positive amount will be added to the current year and reported in Box 1. See the Box 4 worksheet in the Key Information Displayed in WINGS section. Enrollment Services or the Bursar Office can provide a more detailed calculation of Box 4 if necessary.

Scholarship and Grant adjustments related to 2025 activity will be reported in Box 6 if the net adjustments are negative. Adjustments related to 2025 activity that net to a positive amount will be added to current year activity and reported in Box 5. Enrollment Services or the Bursar Office can provide a more detailed calculation of Box 6 if necessary.

Two places you can find your 1098-T:

- Through our E-commerce platform hosted by TouchNet as part of you billing statement option

- As part of your Student Self-service in WINGS

To access through our E-commerce platform via TouchNet (IRS form only, if reported to IRS):

- Sign-on to your WINGS Account

- Select Student Account Center/Bursar Services

- Select Official 1098-T Tax Document

- Under My Account – View Statement

- Select 1098-T Statement

OR

To access your 1098-T through WINGS (with supporting detail):

- Sign-on to your WINGS Account

- Select Student Account Center/Bursar Services

- Select 1098-T Document Information

- Enter a Tax Year

Key Information Displayed in WINGS:

If you access the 1098-T with supporting detail (second method listed above), you can find the following information:

Detail of Payments Received: Shows the terms, details codes and description and amount by term and all terms of the payments received that qualified as 1098-T payments for the year.

Detail of Charges Billed: Shows the terms, details codes and description and amount by term and all terms of the charges billed that qualified as 1098-T charges for the year.

Box 1 - Payments Reportable: This section will show how Box 1 was calculated

|

Tax Year |

Beginning Carry Forward of Unreported Charges Billed (A) |

Current Charges Billed (B) |

Current Decrease Previous Charges (C) |

Box 4 Adjustment (D) |

Cap Limit Charges Billed (E= A+B+C+D) |

Current Payments Received (F) |

Box 1 Payments Reportable (G= (Least E,F)) |

Ending Carry Forward of Unreported Charges Billed (H=E-G) |

|

2025 |

$1,000.00 |

$3,500.00 |

-$1,500.00 |

$500.00 |

$3,500.00 |

$1,400.00 |

$1,400.00 |

$2,100.00 |

Where:

- Beginning Carry Forward of Unreported Charges Billed (A) equals any excess charges over payments received associated with 2025’s 1098-T (if any).

- Current Charges Billed (B) equals the current charges from the Detail of Charges Billed section.

- Current Decrease Previous Charges (C) equals any prior year charge adjustments (negative adjustments). See Supplemental Detail of Related Charges for these adjustments.

- Box 4 Adjustment (D) is the difference between the Prior Year Box 1 and Adjusted Previous Box 1 Payments Reportable. The Adjusted Previous Box 1 Payments Reportable which is the lesser of:

- Adjusted Previous Cap Limit Charges Billed (Previous Cap Limit Charges Billed (A) from prior year) plus Current Decrease Charges Billed (C) (MOST LIKELY SITUATION) or

- Adjusted Previous Payments Received (Previous Payments Received plus Current Decrease Previous Payments).

Below is a Box 4 adjustment worksheet (with numbers as an example):

|

Line |

Line Item |

Example |

|---|---|---|

|

1. |

Prior Year Box 1 |

$2,000.00 |

|

2. |

Previous Cap Limit Charges Billed (from prior year) |

$3,000.00 |

|

3. |

Current Decreased Charges Billed (if any- see Supplemental Detail of Related Charges section) |

-$1,500.00 |

|

4. |

Adjusted Previous Cap Limit Charges Billed (Line 2 less Line 3) |

$1,500.00 |

|

5. |

Previous Payments Received (from prior year) |

$2,000.00 |

|

6. |

Current Decreased Payments Received (if any- see Supplemental Detail of Related Payments section) |

-$200.00 |

|

7. |

Adjusted Previous Payments Received (Line 5 less Line 6) |

$1,800.00 |

|

8. |

Prior Year Box 1 (Line 1) |

$2,000.00 |

|

9. |

Adjusted Previous Box 1 Payments Reportable (lesser of Line 4 or Line 7) |

$1,500.00 |

|

10. |

Box 4 Adjustment (Line 8 less Line 9) |

$500.00 |

Enrollment Services or the Bursar Office can provide a more detailed calculation of Box 4 if necessary.

- Cap Limit Charges Billed (E) equals the sum of:

- Beginning Carry Forward of Unreported Charges Billed (A)

- Current Charges Billed (B) equals the current charges from the Detail of Charges Billed section.

- Current Decrease Previous Charges (C)

- Box 4 Adjustment (D)

- Current Payments Received (F) equals the current payments from the Detail of Payments Received section.

- Box 1 Payments Reportable (G) equals the lesser of Cap Limit Charges Billed (E) or Current Payments Received (F). This is Box 1 on the 1098-T form.

- Ending Carry Forward of Unreported Charges Billed equals Cap Limit Charges Billed (E) less Box 1 Payments Reportable (G). Any amount will carry forward to next year’s reporting.

Supplemental Detail of Related Payments: Provides additional detailed payment information including payment date and scholarships/grants.

- Indicates which payments are for 2025 (Code: PR), which payments are part of the prior year adjustment calculation (Code: AP).

- Shows the scholarships and grants that are included as payments for Box 5 (Code SG) and which scholarships and grants that are included in Box 6 (Code: AS).

Supplemental Detail of Related Charges: Indicates which charges are for 2025 (Code: CB), which charges are part of the prior year adjustment (Code: AC).

Supplemental Detail of Non-Tuition Related Charges: Shows those charges (if any) that did not qualify as QTRE.

Supplemental Detail of Non-Tuition Related Payments: Shows those payments and scholarships/grants (if any) that were not related to QTRE.

1 Not an all-inclusive listing.

GradReady

The choices you make about how you pay for school have a long-term impact, so it’s important to understand your options and make smart decisions today that will help you in the future.

That’s where GradReady comes in. GradReady is a valuable resource that can help you prepare for school.

Best of all, GradReady is a free service provided to help students and families.